Coronavirus has brought about quite a lot of inventory marketplace turbulence and, moderately inevitably, comparisons had been made to the volatility brought about by way of the South Sea Bubble 300 years in the past. This used to be the instant when, in 1720, percentage costs in London boomed after which fell sharply. It is regarded as a big financial crisis and large scandal.

If truth be told, it used to be a scandal however now not a lot of a crisis. Whilst some traders misplaced out from the theory, it didn’t make a lot of a dent within the wider financial system, in contrast to the newer crashes of 1929 and 2008 – and what the long-term financial results can be from COVID-19.

The episode displays how a perceived disaster will also be the topic of intense public outcry and ethical panic, even if other people don’t perceive what has took place. It displays how the narrative informed to the general public can simply diverge from the reality: faux information, if you’ll.

What in fact took place

The actual causes in the back of the bubble are advanced. The South Sea Corporate, which gave its identify to the development, helped the federal government arrange its debt and in addition traded enslaved Africans to the Spanish colonies of the Americas. The federal government struggled to pay holders of its debt on time and traders had issue promoting on their debt to others because of felony difficulties.

So debt holders had been inspired at hand their debt tools to the South Sea Corporate in alternate for stocks. The corporate would gather an annual hobby fee from the federal government, as a substitute of the federal government paying out hobby to a lot of debt-holders. The corporate would then go at the hobby fee within the type of dividends, in conjunction with income from its buying and selling arm. Shareholders may simply promote on their stocks or just gather dividends.

The debt control and slaving facets of the corporate’s historical past have frequently been misunderstood or downplayed. Older accounts state that the corporate didn’t in fact industry in any respect. It did. The South Sea Corporate shipped 1000’s of other people around the Atlantic as slaves, operating with a longtime slave buying and selling corporate referred to as the Royal African Corporate. It additionally gained convoy coverage from the Royal Army. Shareholders had been within the South Sea Corporate as it used to be strongly sponsored by way of the British state.

Via the summer time of 1720, South Sea Corporate stocks changed into puffed up and different firms additionally noticed their percentage costs building up. This used to be partially as a result of new traders got here into the marketplace and were given over excited. As well as, cash got here in from France. The French financial system had gone through an enormous set of reforms below the keep an eye on of a Scottish economist referred to as John Legislation.

Legislation’s concepts had been forward of his time, however he moved too briefly. His makes an attempt to modernise France’s financial system didn’t paintings, partially since the inflexible social machine remained unchanged. The French inventory marketplace boomed after which crashed. Buyers took their cash out of the Paris marketplace – some moved it to London, serving to push up percentage costs there.

Wikimedia

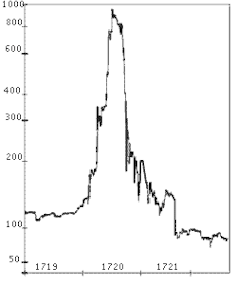

As soon as the South Sea Bubble had began to inflate, it attracted extra naive traders and people who would prey upon them. Whilst it used to be transparent that the prime costs had been unsustainable, canny speculators purchased in hoping to promote out in time. This driven up costs much more, within the quick time period. The inventory value went up from £100 in 1719 to greater than £1,000 by way of August 1720. The inevitable crash backpedal to £100 in line with percentage by way of the tip of the 12 months got here as a surprise to people who idea they may make their fortunes in a single day.

The backlash

The crash provoked massive public outcry. Politicians demanded an inquiry. South Sea Corporate administrators had been accused of treason and fraud. Poems, performs and satirical prints criticised the marketplace and the ones in it. The chancellor of the exchequer used to be in short locked up within the Tower of London. The corporate’s administrators had been compelled to seem in entrance of parliament.

The volume of noise generated by way of those reactions helped make the South Sea Bubble well-known. From then on in, it changed into a byword for economic scandal. But many of us may now not actually provide an explanation for what had took place. Most likely unusually, financial historians can in finding little proof of a chronic financial recession. The bubble burst however with out the most important results of later economic crises.

Wikimedia

So why all of the fuss? First, the crash took place within the early days of the inventory marketplace. There used to be no frame of monetary concept or economic journalism which might lend a hand provide an explanation for it to laypeople. They grew to become as a substitute to conspiracy theories or bizarre concepts about other people changing into playing mad.

2d, there used to be communicate of other people being given their a refund. This gave losers each incentive to speak up their losses. It’s human nature to whinge, even a couple of small loss. The preferred belief is that fab fortunes had been destroyed, however there’s little proof of this past one or two circumstances.

3rd, this used to be an excellent alternative for schadenfreude and more than a few kinds of prejudice to be expressed. Feminine traders had been lampooned by way of misogynists. Foreigners and more than a few spiritual teams had been the topic of racist observation. There used to be no skilled research to be had and commentators, and not using a genuine figuring out of finance, equipped scandal and scapegoating as a substitute of correct reporting.

The South Sea Bubble has been a logo of monetary disaster for 300 years. However like different extra trendy crises, its public symbol diverges from the truth. The similar more than likely can’t be mentioned for the COVID-19 pandemic, which can have a a lot more deep and lasting impact at the international financial system.

Supply Via https://theconversation.com/300-years-since-the-south-sea-bubble-the-real-story-behind-the-iconic-financial-crash-143861