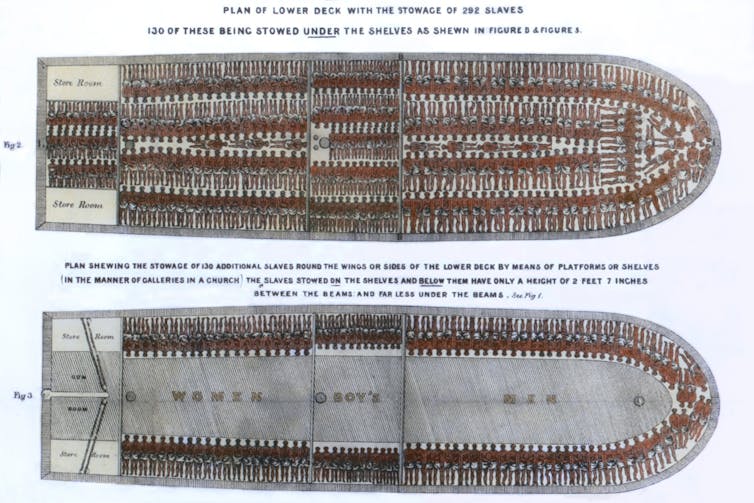

When the notorious Zong trial started in 1783, it laid naked the poisonous dating between finance and slavery. It used to be an odd and distressing insurance coverage declare – relating to a bloodbath of 133 captives, thrown overboard the Zong slave send.

The slave industry pioneered a brand new more or less finance, secured at the our bodies of the powerless. As of late, the arcane merchandise of prime finance, concentrated on the deficient and bothered as cash in alternatives for the already-rich, nonetheless undergo that deep unfairness.

The Gregsons, claimants within the Zong trial, have been service provider princes of 18th century Liverpool, a town that had briefly grown to be one of the vital global’s main industrial capitals. The grandiose Liverpool Trade construction, opened in 1754, boasted of the town’s industrial good fortune and the supply of its cash, its friezes adorned with carvings of African heads.

However Liverpool’s wealth additionally stemmed from its inventions in finance. The nice slave traders have been additionally bankers and insurers, pioneers in what we as of late name financialisation – they remodeled human lives into profit-bearing alternatives.

From the perspective of traders, the Atlantic industry used to be gradual, unreliable and dangerous. Ships have been threatened by way of illness, by way of deficient climate, and by way of the consistent danger of rebellion. To hurry up the float of cash, traders started to factor credit score notes that might commute rapidly and safely around the ocean.

Slaves can be bought in Britain’s African colonies and transported to the Americas the place they have been bought at public sale. The service provider’s agent would take the cash gained and somewhat than making an investment it in commodities like sugar or cotton to be despatched again to Liverpool, they’d ship a invoice of change – a credit score word for the sum plus pastime – around the Atlantic.

The invoice of change may well be cashed at a cut price at one of the vital many banking properties within the town, or changed by way of some other, once more at a cut price, to be dispatched to Africa in fee for extra human chattels. Credit score flowed rapidly, cleanly and profitably.

Obscenely novel

This evolution of personal credit score didn’t originate in Liverpool. It had underpinned the Florentine banking dynasties of the fifteenth century and gave upward push to cash as we are aware of it now.

Everett Assortment / Shutterstock

The obscene novelty of the slavers’ banking machine used to be that this economic price used to be secured on human our bodies. The similar practices persisted at the plantations, the place the our bodies of slaves have been used as collateral on loans permitting the growth of estates and the purchase of but extra productive our bodies. The slaves have been exploited two times: their freedom and labour stolen from them, their captured “financial price” leveraged by way of leading edge economic tools.

The Liverpool traders additionally pioneered the usage of insurance coverage as a way of ensuring the economic price of the their commodities. The slavers had lengthy recognised that the one solution to continue to exist the occasional overall losses that expeditions incurred used to be to assemble in combination in syndicates and proportion the chance.

So when the captain of the Zong realised he used to be not likely to land his shipment of sickening and malnourished slaves, he ordered 133 souls to be thrown overboard. The perverse prison good judgment used to be that if a part of the shipment needed to be jettisoned to save lots of the send, it might be lined by way of the insurance coverage.

Those bodies-as-financial-commodities had handiest speculative price. Insurance coverage made it actual and bankable. This used to be true in 18th century Liverpool and it stays so in twenty first century Wall Boulevard.

Wikimedia

Financialisation as of late

Financialisation has since taken many paperwork, however elementary components stay the similar. It’s in keeping with asymmetric energy members of the family that seize long run particular person responsibilities and lead them to saleable. The contracts underlying the 2008 credit score disaster, for instance, became long run loan bills into tradeable economic securities with precise provide price.

For the ones issuing the bonds, the cash in used to be possibility loose. The danger used to be borne by way of predominantly deficient American citizens, whose a bad credit score scores and loss of economic abilities made them simple prey for the issuers of mortgages so built as to fasten them into financial bondage. Those folks have been disproportionately black, Latino or migrant.

Insurance coverage performed an element right here, solidifying the speculative price of investments to the good thing about investors. And when the bubble after all burst governments stepped in to care for the program, america Federal Reserve supporting large insurer AIG to the track of US$182 billion (£139 billion) whilst many of us misplaced their properties.

The credit score disaster bailout is eerily paying homage to some other. By the point of abolition slave possession used to be so embedded in British society that the federal government used to be compelled to compensate particular person homeowners for the lack of their capital – it required a huge mortgage that taxpayers handiest completed paying off in 2015.

I’m now not pronouncing that bankers as of late are like slave investors. However I’m pronouncing that recent finance remains to be riddled with regimes of dominance and exploitation at paintings.

Take recent philanthrocapitalism, the place finance seeks to do excellent whilst additionally reaping rewards buyers. Novel economic tools place social issues as a possibility for cash in. The our bodies of prisoners, for instance, transform implicated in schemes to forestall recidivism with non-public personality reform the cause for funding payouts.

Schemes akin to this make social issues the accountability of people and forget about the structural members of the family of austerity that lie in the back of them. Finance wins two times, praised for fixing the exact same issues that it has benefited from developing.

Beware financiers bearing presents. Scholar loans, loan bonds, social have an effect on bonds, even biodiversity making an investment – all incomes rents from the captured long run actions of moderately powerless folks – undergo the shadow of the Atlantic industry.

Supply Via https://theconversation.com/how-the-shadow-of-slavery-still-hangs-over-global-finance-144826