Monetary markets can let us know so much in regards to the financial restoration forward, in response to their course of commute and the way assured traders really feel in regards to the long run. That is vital as we emerge from the COVID-19 pandemic. There’s a lot debate about whether or not the industrial restoration shall be a V-shape, indicating a short-lived financial downturn with a handy guide a rough go back to earlier ranges of output. Or if the restoration will take longer, following a U-shape. Or it might be extra like an L-shape, with out a near-term restoration and in the end taking a few years and even a long time.

Gold costs have hit a file top. This means how fearful traders are in regards to the financial restoration. However the indicators aren’t all dangerous. A have a look at 5 vital signs unearths a mixture of all 3 restoration shapes and presentations that monetary markets are unsure in regards to the financial restoration forward.

1. Gold

Gold as retailer of price is observed as a secure asset. As gold does no longer produce any source of revenue in relation to dividends or passion bills it’s avoided all over excellent instances (when shares are in favour). However its intrinsic price involves the fore all over instances of monetary issue when gold costs move up.

Buying and selling Economics

The cost of gold has spiked to above the extent discovered within the years following the 2007-08 international monetary disaster, which raised quite a few questions across the viability of sovereign debt. That gold has reached this stage once more means that traders stay cautious.

Learn extra:

Why gold costs move up and down – 5 charts

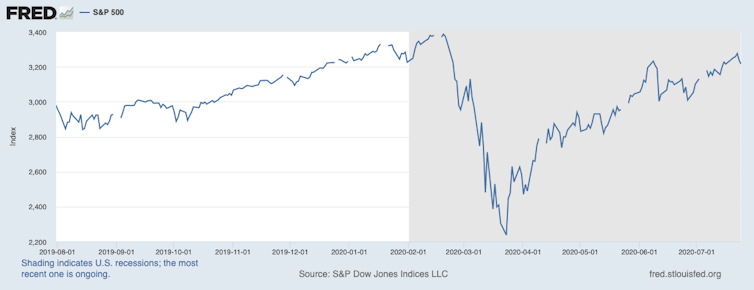

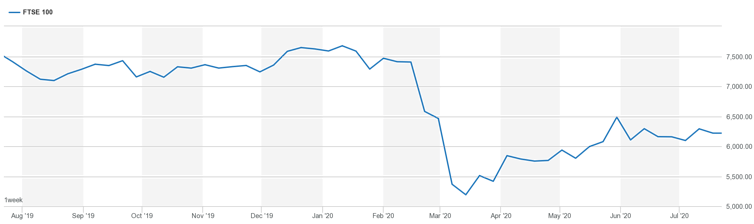

2. Inventory markets

Inventory costs range considerably and are in most cases thought to be being a number of the riskiest of investments. If a company is going bankrupt then traders can lose all their cash.

The S&P 500, one of the most key inventory indexes in the USA, is beneath the extent it began at this yr however is above the extent it was once right now ultimate yr. It’s V-shaped, even though the upstroke is a bit of wobbly and persisted uncertainty lately prevents a complete restoration.

FRED

The view from any other markets, on the other hand, is much less constructive. As an example, the United Kingdom’s primary index, the FTSE 100, remains to be a way from recuperating its pre-COVID place and has a relatively upward sloping L-shape.

London Inventory Alternate

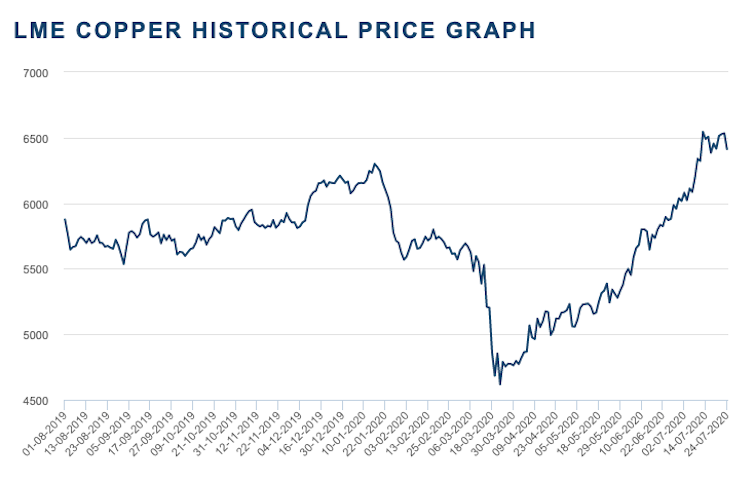

3. Copper

Copper is essentially the most extensively used commercial steel. If items are being made, and economies are increasing, then copper is in call for and the copper value will upward push. Copper costs dropped firstly of the yr when China was once in lockdown. There was once an additional hunch as coronavirus hit Europe and the USA in March.

China is the arena’s greatest importer of copper and is accountable for just about 50% of worldwide copper imports. So the cost of copper is in large part pushed through call for from China and the rise in value from the bottom level round March 19 is in keeping with the easing of the shutdown duration in China. So the copper restoration presentations indicators of an elongated V-shape, most likely stretching right into a U.

London Steel Alternate

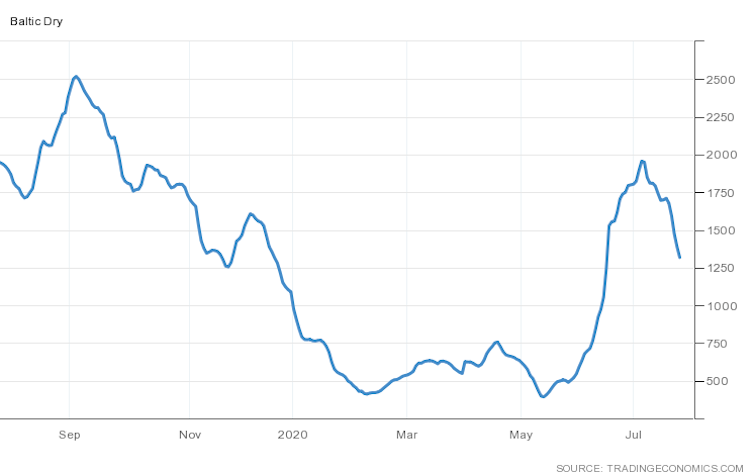

4. Baltic Dry Index

If items are being made, they then want to be shipped to their ultimate vacation spot. The Baltic Dry Index is a composite index of the price of transport primary uncooked fabrics. If items are being shipped around the globe from the producer to the shopper then the index will upward push.

Buying and selling Economics

This index is no longer simplest above its preliminary US/Eu lockdown stage, however has additionally returned to the degrees it was once at previous to China’s shutdown. This means a upward push in production output and hope for exports. The dip on the finish of the graph does sign a caution that uncertainty stays, on the other hand.

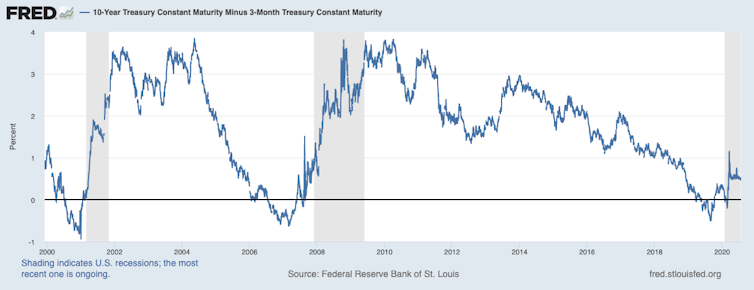

5. Executive bonds

Like gold, every other asset that’s observed as more secure to spend money on all over crises is executive bonds, for the reason that governments (in most cases) don’t move bankrupt and fail to pay off their money owed. When traders are frightened about long run financial possibilities, they purchase executive bonds, this then makes those bonds costlier and decreases the yield that they pay (executive bonds pay a hard and fast money passion cost).

The yield on bonds may be suffering from financial coverage operated through the central financial institution, with decrease rates of interest set in weaker financial climates to inspire other folks to spend. So, we will be able to evaluate yields of various duration bonds (referred to as the time period construction), the place the next yield signifies a extra sure outlook.

FRED

We will be able to take a relatively longer time point of view and spot from the graph above that, at the one hand, the upturn within the time period construction signifies a restoration. However, then again, the upward thrust turns out to have stalled indicating uncertainty going ahead.

Total, the proof means that traders are undecided. That they’re purchasing shares and the products utilized in manufacturing is an indication of hope that the worldwide economic system will recuperate briefly. However gold costs additionally give a dose of realism.

This text is a part of our Restoration sequence – click on right here for extra.

Supply By way of https://theconversation.com/five-graphs-that-show-how-uncertain-markets-are-about-the-coronavirus-recovery-143475